Elevate your lending strategy with Finanta’s comprehensive Reporting and Analytics Module, where data meets decision-making.

Finanta’s Reporting and Analytics Module is engineered to provide lenders with a deep understanding of their loan portfolio’s performance, risks, and opportunities. By offering customizable reporting tools, advanced analytics, and seamless integration with business intelligence (BI) tools, Finanta empowers lenders to navigate the complexities of the lending landscape with confidence and precision.

Generate insightful reports tailored to your specific needs, providing clarity on portfolio performance, risk, and profitability.

Enhance your analysis with integration capabilities for leading BI tools and third-party data sources, expanding your analytical horizon.

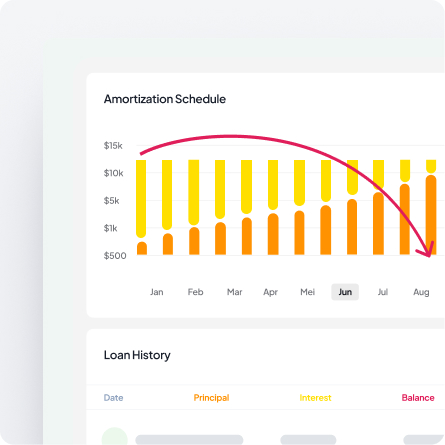

Leverage sophisticated analytics and data visualization features to uncover trends, patterns, and opportunities for better decision-making.

Stay ahead with detailed tracking and reporting on non-performing loans, ensuring adherence to regulatory standards and proactive risk management.

Loan Portfolio Performance Reports

Gain a holistic view of your portfolio’s health, with breakdowns by loan type, industry, geographic region, and risk rating, ensuring a clear understanding of interest income, principal repayments, past dues, and charge-offs.

Compliance and Regulatory Reports

Ensure compliance with lending regulations through submission-ready reports covering capital adequacy, liquidity ratios, and loan loss provisioning, safeguarding your operations against regulatory challenges.

Risk Analysis Reports

Conduct thorough credit risk assessments, including exposure levels, risk concentrations, and default probabilities, complemented by stress testing results to anticipate the impact of economic shifts on portfolio health.

Financial Statements & Performance Metrics

Review essential financial statements and key performance indicators (KPIs) such as return on assets (ROA), net interest margin (NIM), and loan-to-deposit ratio to gauge overall lending performance.

Customer and Relationship Reports

Identify high-value clients and segments for targeted marketing through customer profitability analysis, and explore relationship cross-sell opportunities to expand your service offerings.

Loan Concentration Analysis

Manage concentration risk by highlighting exposure to specific industries, geographic regions, or borrower types, ensuring a balanced risk distribution across your loan portfolio.

Operational Efficiency Reports

Monitor the efficiency of your loan origination and closing processes with time-to-approval and time-to-fund metrics, and evaluate the performance of your loan officers and underwriting teams.

Collateral Valuation and Exposure Reports

Stay informed about the current valuation of collateral securing loans and analyze loan-to-value ratios to mitigate exposure to collateral value fluctuations.

Delinquency and Default Reports

Access detailed aging schedules for past-due loans and analyze non-performing loans, recovery rates, and loss severities to maintain portfolio integrity.

Simplify the overwhelming influx of data with Finanta’s customizable reporting tools, ensuring you focus on the metrics that matter most to your lending strategy.

Proactively identify and mitigate risks with comprehensive risk analysis reports, stress testing, and real-time monitoring of non-performing loans, safeguarding your portfolio’s health.

Stay ahead of regulatory demands with Finanta’s compliance and regulatory reports, ensuring your lending operations meet all applicable standards and avoid potential penalties.

Streamline your lending processes with operational efficiency reports, tracking key metrics like time-to-approval and staff productivity to optimize performance and reduce bottlenecks.

Unlock the potential of your customer data with Finanta’s customer and relationship analytics, enabling targeted marketing and cross-selling opportunities to enhance customer engagement and profitability.

Finanta’s Reporting and Analytics Module is not just a tool; it’s a strategic asset that transforms data into actionable insights, driving informed decisions and fostering a culture of transparency and accountability in commercial lending. Embrace the power of analytics with Finanta and chart a course for success in your lending operations.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

“By leveraging Finanta’s comprehensive commercial lending solutions suite, IBC Bank will not only enhance their operational efficiencies but also provide their clients with superior lending products and services tailored to the dynamic commercial lending sector.”

Finanta offers fully customizable reporting tools that allow you to generate insights tailored to your specific needs. You can create reports on portfolio performance, risk exposure, profitability analysis, loan pipeline status, non-performing loan (NPL) tracking, borrower concentration, and regulatory compliance metrics. The platform provides both standard templates and the flexibility to build custom reports that align with your unique lending operations and stakeholder requirements.

Yes. Finanta seamlessly integrates with leading business intelligence tools such as Tableau, Power BI, and other BI platforms, as well as third-party data sources. This integration expands your analytical capabilities, allowing you to combine Finanta’s lending data with other business data for comprehensive enterprise-wide analysis. You can leverage advanced data visualization and analytics features to uncover trends, patterns, and opportunities for strategic decision-making.

Finanta provides detailed tracking and reporting specifically for non-performing loans, with automated alerts for early warning signs of potential defaults. The platform monitors payment patterns, tracks delinquencies, generates NPL reports for regulatory compliance, and provides analytics to identify root causes and trends. This proactive approach enables you to implement timely intervention strategies and maintain adherence to regulatory standards while minimizing portfolio risk.