Navigate the complexities of commercial lending with confidence. Finanta’s Compliance Checks module delivers the robust oversight your business demands.

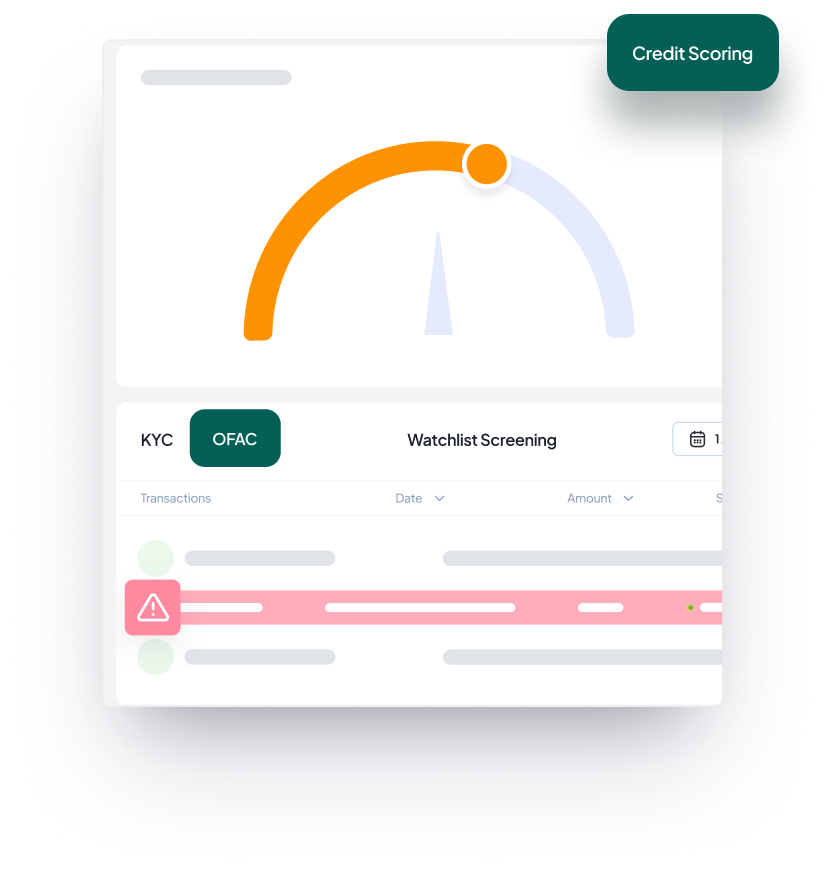

In the high-stakes world of commercial lending, regulatory compliance is not just a requirement—it’s the cornerstone of trust and integrity. Finanta’s Regulatory Compliance Check module is engineered to provide comprehensive risk management and compliance solutions that integrate seamlessly with third-party services for an in-depth credit and risk scoring, including KYC, OFAC, and document verification.

Employing a wide array of risk rating models, Finanta offers thorough risk assessments to accurately evaluate borrower creditworthiness and monitor portfolio risk.

With real-time monitoring and reporting, stay ahead of regulatory requirements with our automated AML and KYC checks.

Our module extends beyond individual compliance, encompassing KYB for comprehensive corporate due diligence, ensuring every aspect of your lending process adheres to the highest standards of compliance.

Advanced Risk Analysis

Finanta provides meticulous registry checks to ensure all regulatory requirements are met, along with Ultimate Beneficial Owner (UBO) detection to maintain transparency and comply with global regulations.

Company Documentation and Continuous Update

Keep your corporate documentation in check and regularly updated, ensuring your records reflect the latest compliance status and regulatory information.

AML Compliant and Full Risk Report

Stay compliant with anti-money laundering directives with our AML tools, and gain a complete overview of potential risks with comprehensive reporting capabilities.

LEI and Tax ID Verification

Validate the legal entity identifier (LEI) and Tax ID with precision, streamlining due diligence processes and verifying the identity of entities effectively.

Detailed Investigation and Full Audit Trail

Conduct in-depth investigations with ease and maintain a full audit trail for unparalleled insight and audit readiness.

By integrating Finanta’s Compliance Checks into your lending operations, you take control of regulatory risks and ensure compliance with ease and efficiency. Our platform is a critical ally in navigating the intricate compliance landscape of commercial lending, providing the tools you need to focus on growth and customer service.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

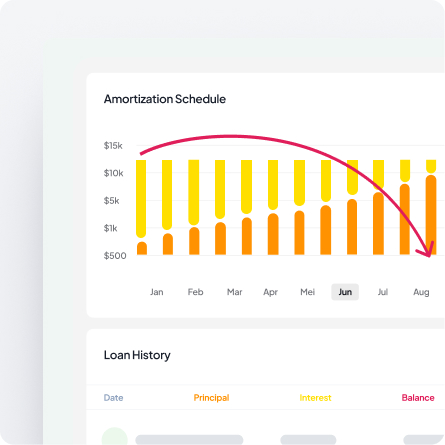

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

“By leveraging Finanta’s comprehensive commercial lending solutions suite, IBC Bank will not only enhance their operational efficiencies but also provide their clients with superior lending products and services tailored to the dynamic commercial lending sector.”

Finanta’s Regulatory Compliance Check module provides comprehensive oversight including KYC (Know Your Customer) verification, OFAC (Office of Foreign Assets Control) screening, AML (Anti-Money Laundering) checks, and document verification. The platform integrates seamlessly with third-party compliance services to deliver in-depth credit and risk scoring, ensuring your lending operations meet all regulatory requirements automatically.

Finanta provides automated compliance monitoring and risk management tools that continuously screen borrowers and transactions against regulatory requirements. The platform maintains comprehensive audit trails, generates compliance reports, and alerts you to potential issues before they become violations. This proactive approach helps you navigate the complex compliance landscape with confidence while focusing on growth and customer service.

Yes. Finanta’s platform is designed to adapt to the evolving regulatory landscape. Through our integrations with leading third-party compliance services, the system automatically updates to reflect new regulations and compliance requirements, ensuring your lending operations remain compliant without manual intervention or system updates.