Enhance your lending ecosystem and experience a world of seamless integration and elevated efficiency with Finanta, where every service enhances your lending journey.

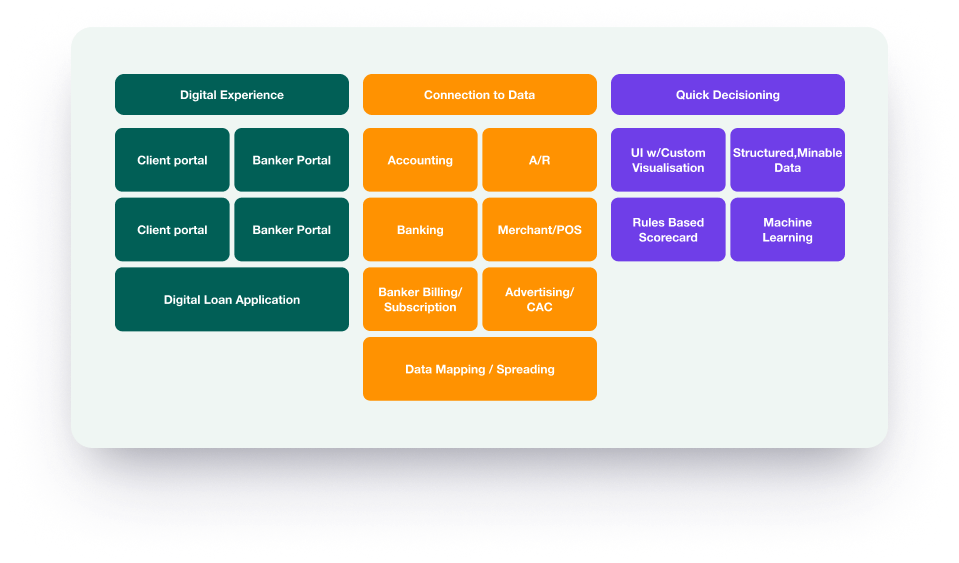

In the evolving landscape of commercial lending, the integration of marketplace services stands as a cornerstone for success. Finanta’s Marketplace Services Integration Module is crafted to provide lenders with a seamless, efficient, and comprehensive lending experience. By integrating essential services into our platform, we ensure operational efficiency, compliance adherence, and enhanced customer satisfaction, all within the Finanta ecosystem.

Seamlessly integrate with systems like PandaDoc, Hyland, and Jotform for streamlined handling and storage of loan documentation.

Conduct quick and accurate KYC/AML checks with services like Trulioo or LexisNexis, enhancing customer verification and anti-money laundering compliance.

Utilize electronic signature solutions for effortless document signing, ensuring a paperless and efficient loan processing experience.

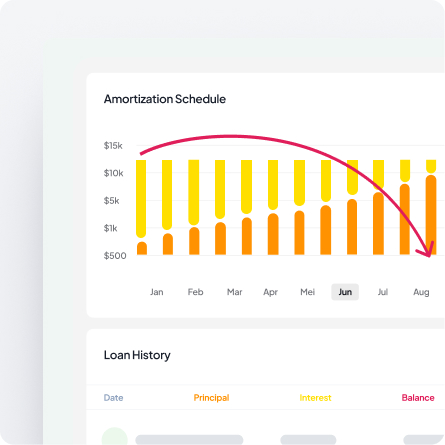

Stay ahead with detailed tracking and reporting on non-performing loans, ensuring adherence to regulatory standards and proactive risk management.

Document Management and Signing

Integrate with top document management systems for efficient document handling and utilize electronic signature solutions for easy signing and management.

Lien Management & Regulatory Compliance

Implement lien tracking systems and flood certification services for compliance, and utilize compliance management tools for up-to-date regulatory adherence.

Data Aggregation and Analysis

Securely aggregate financial data from various sources and use automated financial analysis tools to assess borrower creditworthiness.

Due Dilligence and KYC/AML

Automate KYC/AML checks for swift customer verification and integrate corporate due diligence tools for in-depth business entity analysis.

Credit Assessments & Evaluations

Incorporate real-time credit scoring models and collateral evaluation tools to maintain accurate loan-to-value ratios.

Finanta’s Marketplace Services Integration Module tackles several critical challenges in commercial lending

Proactively identify and mitigate risks with comprehensive risk analysis reports, stress testing, and real-time monitoring of non-performing loans, safeguarding your portfolio’s health.

Stay ahead of regulatory demands with Finanta’s compliance and regulatory reports, ensuring your lending operations meet all applicable standards and avoid potential penalties.

Simplify the overwhelming influx of data with Finanta’s customizable reporting tools, ensuring you focus on the metrics that matter most to your lending strategy.

Finanta’s Marketplace Services Integration Module is more than just a feature; it’s a transformative tool that redefines the commercial lending experience. By choosing the right mix of integrations, lenders can offer a robust, user-friendly, and compliant service, setting a new standard in the competitive landscape of commercial lending.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

“By leveraging Finanta’s comprehensive commercial lending solutions suite, IBC Bank will not only enhance their operational efficiencies but also provide their clients with superior lending products and services tailored to the dynamic commercial lending sector.”

Finanta integrates with a comprehensive range of leading marketplace services including document management systems (PandaDoc, Hyland, Jotform), KYC/AML verification providers (Trulioo, LexisNexis), electronic signature solutions (DocuSign, Adobe Sign), credit bureaus, valuation services, and compliance screening tools. These integrations create a complete lending ecosystem within the Finanta platform, eliminating the need to switch between multiple disconnected systems.

By integrating essential services directly into the Finanta platform, lenders can streamline workflows and eliminate manual data entry between systems. Document management becomes seamless, KYC/AML checks happen automatically during application processing, and electronic signatures enable paperless loan execution. This integration reduces processing time, minimizes errors, and allows your team to manage the entire lending process from a single unified platform.

Yes. Finanta offers flexibility in selecting the right mix of marketplace integrations based on your specific business needs, existing vendor relationships, and operational requirements. You can integrate only the services that add value to your lending operations, and easily add or modify integrations as your needs evolve. This customizable approach ensures you’re not locked into specific vendors and can optimize your technology stack over time.