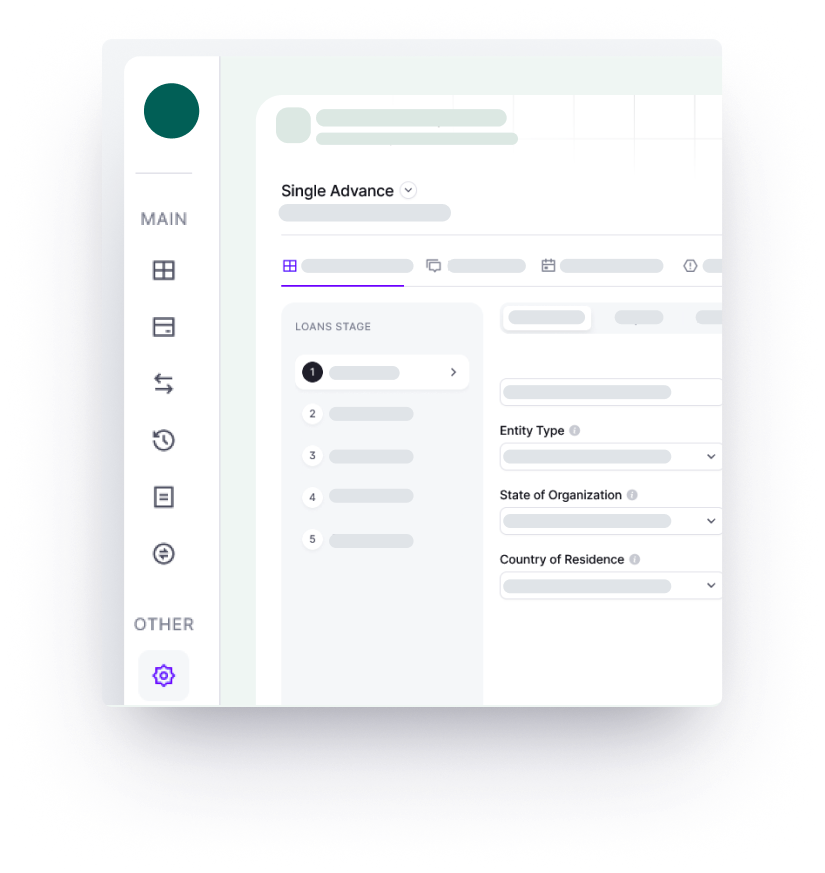

Elevate your commercial loan processing and underwriting for the American market with Finanta’s scalable and secure LOS and Underwriting module. A customizable, scalable, and collaborative platform to truly transform your loan origination process

Our Loan Origination and Underwriting module is engineered to seamlessly blend into your existing IT infrastructure, ensuring data consistency and operational efficiency while offering a unified customer experience. With Finanta, you empower your lending operations with scalability, flexibility, comprehensive risk assessment, regulatory compliance management, and unparalleled efficiency in application processing.

Finanta effortlessly integrates with your existing core banking systems, CRM platforms, and financial software, maintaining data consistency and streamlining operations for a unified customer experience.

Incorporating both traditional and alternative data sources, Finanta provides a holistic view of a borrower's creditworthiness, accommodating unique aspects of commercial lending, from business plan evaluation to cash flow projections and industry-specific risks.

Designed to handle varying volumes of loan applications, our platform adapts to changing business needs, regulatory requirements, and market conditions with minimal IT involvement, ensuring your lending operations are always at the forefront of efficiency.

Stay ahead of regulatory changes with automated compliance checks and audit trails. Finanta ensures adherence to AML, KYC, ECOA, and more, safeguarding your operations against compliance risks.

Reduce manual entry and paperwork with tools designed for efficient document management, application tracking, and workflow automation, enhancing processing times and accuracy.

Custom Rule Configuration

Configure rules for any collateral-based or unsecured loan product, alongside configurable forms, roles, entitlements, and audit tracking, aligning perfectly with your institutions policies and industry regulations.

Effortless Sync With Core Banking System

Achieve operational excellence with seamless integration across several core banking systems, enhancing your capability to track and manage financial operations efficiently.

Custom Rule Configuration

Configure rules for any collateral-based or unsecured loan product, alongside configurable forms, roles, entitlements, and audit tracking, aligning perfectly with your institutions policies and industry regulations.

Custom Rule Configuration

Configure rules for any collateral-based or unsecured loan product, alongside configurable forms, roles, entitlements, and audit tracking, aligning perfectly with your institutions policies and industry regulations.

Comprehensive Decision Support System

Our comprehensive decision support system, including loan pricing models, profitability analysis, and scenario simulation, ensures you’re equipped to make strategic decisions with confidence.

36 Types of Collaterals Supported

Whether catering to local businesses or expanding your reach internationally, Finanta supports over 36 types of collateral out-of-the-box, ensuring you’re equipped for any lending scenario.

With Finanta, you’re not just adopting a platform; you’re embracing a future where commercial lending is defined by efficiency, security, and strategic insight. Our solution is designed to address the essential challenges of today’s lending market, ensuring you’re equipped to navigate the complexities of domestic and international lending, regulatory compliance, and risk management with ease.

Transform your lending operations with Finanta. Our platform not only meets the current needs of commercial lenders but is also future-proofed to adapt to emerging technologies and industry changes. Embrace a solution that enhances productivity, ensures compliance, and delivers a superior experience for both borrowers and staff.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

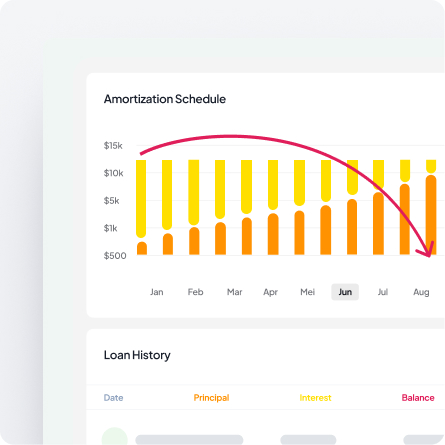

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

“By leveraging Finanta’s comprehensive commercial lending solutions suite, IBC Bank will not only enhance their operational efficiencies but also provide their clients with superior lending products and services tailored to the dynamic commercial lending sector.”

Finanta seamlessly integrates with your existing core banking systems, CRM platforms, and financial software through robust APIs and connectors. Our platform maintains data consistency across all systems while ensuring a unified customer experience. The integration process requires minimal IT involvement and is designed to work within your current infrastructure without disruption.

Yes. Finanta is designed to handle varying volumes of loan applications, from dozens to thousands. The platform adapts to your changing business needs, regulatory requirements, and market conditions with minimal IT involvement, ensuring your lending operations remain efficient as you grow—whether you’re a regional lender or a national institution.

Finanta features automated compliance checks and comprehensive audit trails that ensure adherence to AML, KYC, ECOA, and other key lending regulations. The platform automatically updates to reflect regulatory changes, helping you stay ahead of compliance requirements and reducing the risk of violations or penalties.