In the dynamic world of equipment leasing and financing, staying ahead requires innovative and efficient solutions. Finanta is dedicated to empowering equipment leasing and financing companies with advanced software solutions that streamline operations, enhance customer experiences, and drive profitability.

Equipment Leasing and Financing companies face a multitude of challenges that threaten to undermine their competitiveness and efficiency.

Complex Contract Management

Handling diverse lease and finance agreements with varying terms and conditions.

Regulatory Compliance

Navigating an evolving regulatory landscape and ensuring adherence to standards.

Risk Management

Assessing and mitigating risks associated with equipment valuation and customer creditworthiness.

Operational Efficiency

Streamlining processes to reduce costs and improve turnaround times.

Customer Engagement

Providing seamless and personalized experiences to retain and attract customers.

Our comprehensive suite of lending software is designed to empower your bank with cutting-edge tools for every aspect of commercial lending

Simplify the management of complex lease and finance agreements with our robust contract management tools.

Stay ahead of regulatory changes and ensure compliance with our integrated compliance management system.

Evaluate equipment value and customer creditworthiness accurately with our advanced risk assessment models.

Enhance operational efficiency by automating routine tasks, reducing manual errors, and speeding up processes.

Strengthen customer engagement with our CRM tools, providing personalized experiences and seamless communication.

Automate the application and decision-making process with our digital origination and decisioning tools, enabling faster approvals and disbursements.

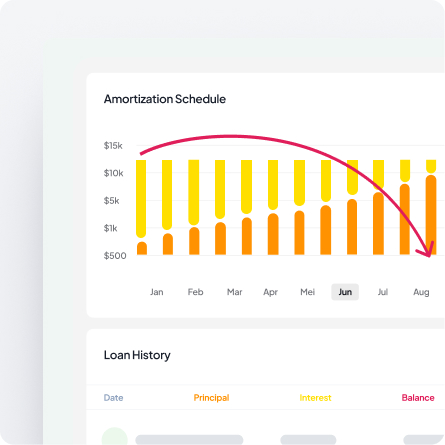

Efficiently manage your entire equipment leasing and financing portfolio with our comprehensive portfolio management system.

Gain valuable insights and make data-driven decisions with our advanced reporting and analytics capabilities.

Our solution is designed to drive significant improvements across key metrics, ensuring your institution stays competitive and efficient in a rapidly evolving market:

Efficiently manage diverse contracts, reducing administrative overhead and errors.

Make informed decisions with accurate risk assessments, minimizing losses.

Minimize compliance risks and stay ahead of regulatory changes.

Enhance customer satisfaction and loyalty with personalized experiences and effective communication.

Accelerate the lending cycle with digital origination and decisioning, leading to quicker disbursements.

Optimize commercial loan origination for a 40% efficiency boost.

Achieve upto 72% reduction in cost overheads

Automate loan management for a powerful 55% increase in loan volumes.

Cut risk exposure by up to 33% with our advanced risk assessment tools.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

Finanta efficiently manages the full spectrum of equipment leasing contracts—from master lease agreements and operating leases to finance leases and sale-leasebacks. The platform handles varying terms, payment structures, residual values, and equipment types within a unified system, reducing administrative overhead and minimizing errors. Automated contract tracking, renewal management, and payment scheduling ensure accurate administration across your entire portfolio, regardless of contract complexity or diversity.

Finanta dramatically accelerates the lending cycle through digital origination and automated decisioning capabilities. The platform enables borrowers to submit applications online, automatically pulls credit data and equipment valuations, applies pre-configured underwriting criteria, and delivers instant or near-instant credit decisions for qualifying transactions. This streamlined approach leads to quicker disbursements, improved customer satisfaction, and the ability to capture time-sensitive equipment financing opportunities before competitors.

Finanta delivers comprehensive risk assessment tools tailored to equipment leasing and financing, including automated credit scoring, equipment depreciation modeling, residual value analysis, and industry-specific risk factors. The platform evaluates both borrower creditworthiness and equipment-specific risks—such as technological obsolescence, market demand, and asset liquidity. These accurate risk assessments enable informed decision-making, appropriate pricing, and minimized losses across your equipment portfolio.