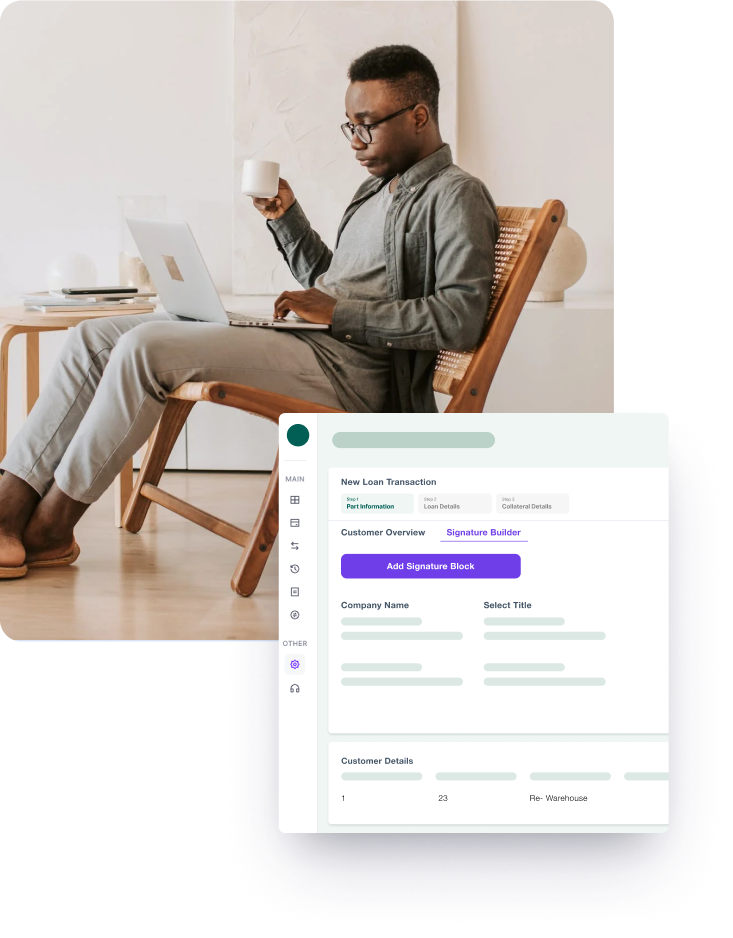

Unlock the power of speed and security in your commercial lending decisions with Finanta’s Digital Credit Presentation. Experience a leap in operational efficiency and smarter lending models, all within our comprehensive Finanta platform.

In the fast-paced world of commercial lending, the gap between application submission and decision-making can be a critical factor in securing opportunities and fostering business growth. Recognizing this, Finanta introduces its groundbreaking Digital Credit Presentation feature, designed to drastically reduce the “time to decision” from the industry standard of 3-5 weeks to mere days.

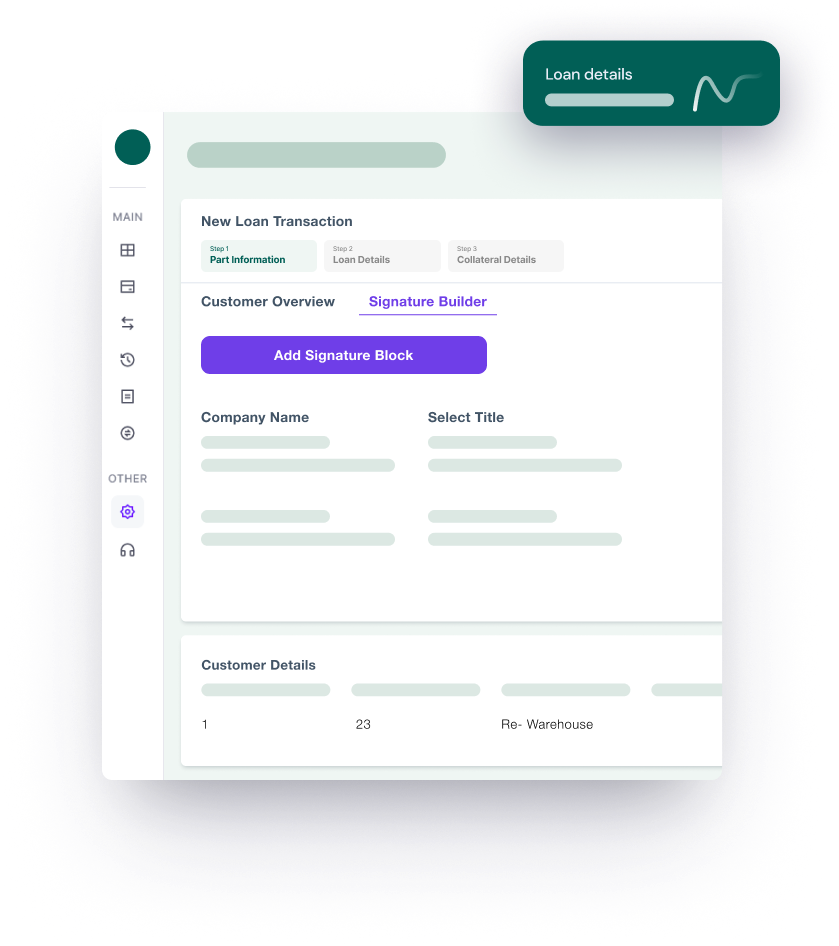

With Digital Credit Presentation , we offer standardized templates for loan narratives, ensuring a uniform, efficient analysis process. This approach not only simplifies the creation of loan packages but also enhances the quality of decision-making.

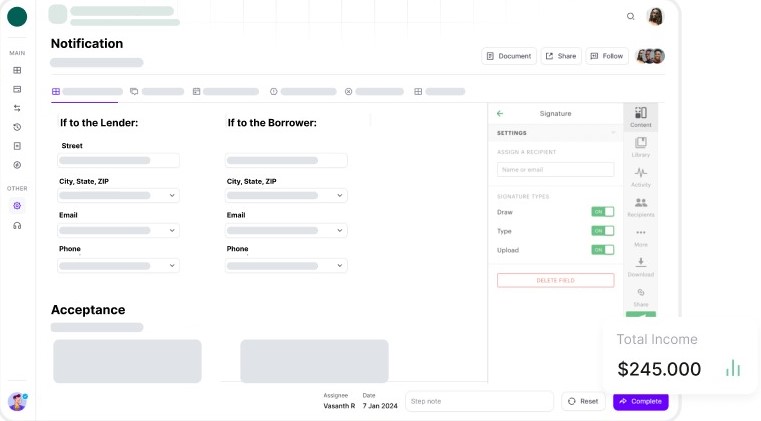

Recognizing the sensitivity of financial credit information, Digital Credit Presentation guarantees stringent security measures and stricter access controls. Credit presentations and related documentation are securely stored and transmitted, accessible across devices— be it mobile, tablet, or desktop.

Our platform automatically integrates concerned authorities into the process, facilitating seamless collaboration and faster consensus on lending decisions.

By standardizing loan narratives and enabling easier collaboration, Digital Credit Presentation paves the way for faster processes and greater operational efficiency, setting the stage for the development of smarter lending models.

Standardized Loan Narrative Templates

Finanta’s Digital Credit Presentation feature comes equipped with standardized templates that streamline the creation of compelling loan narratives, ensuring consistency and clarity in every credit presentation.

Secure and Controlled Environment

With Digital Credit Presentation, your sensitive financial and credit information is securely managed. We employ the most stringent security protocols and access controls to protect your data at every step.

Automated Authority Inclusion

Our system automatically pulls in the relevant authorities and decision-makers into the lending process, enhancing the speed and efficiency of decision-making.

Cross-Device Accessibility

Whether you’re on the move or at the office, access to credit presentations and documentation is seamless and secure across all your devices, ensuring you’re always equipped to make informed decisions

Enhanced Collaboration and Efficiency

Digital Credit Presentation feature is engineered to foster collaboration among all stakeholders in the lending process, leading to quicker decisions and more operational efficiency. This collaborative environment, supported by standardized narratives, lays the foundation for smarter, data-driven lending models.

Transform the way you approach commercial lending with Finanta’s Digital Credit Presentation. Step into a future where decisions are faster, processes are streamlined, and your data remains secure, all within the comprehensive ecosystem of the Finanta platform.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

“By leveraging Finanta’s comprehensive commercial lending solutions suite, IBC Bank will not only enhance their operational efficiencies but also provide their clients with superior lending products and services tailored to the dynamic commercial lending sector.”

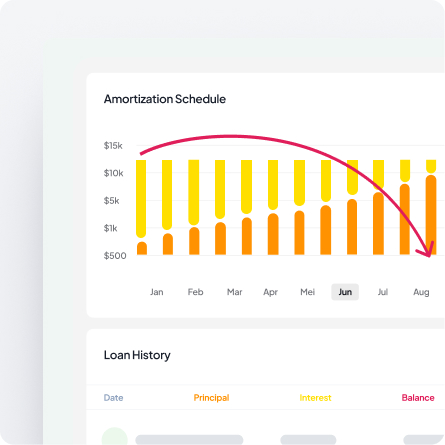

Finanta’s Digital Credit Presentation dramatically reduces the time to decision from the industry standard of 3-5 weeks to just a few days. By using standardized templates for loan narratives and enabling seamless collaboration among stakeholders, the platform eliminates bottlenecks in the credit approval process, allowing you to make faster lending decisions and capture more business opportunities.

Digital Credit Presentation implements stringent security measures and strict access controls to protect sensitive financial and credit information. All credit presentations and related documentation are securely stored and transmitted with encryption. The platform provides role-based access controls, ensuring only authorized personnel can view or modify credit presentations, and is accessible securely across all devices—mobile, tablet, or desktop.

The platform automatically integrates all relevant stakeholders—including credit analysts, relationship managers, underwriters, and decision-makers—into the credit review process. Standardized templates ensure everyone is working from consistent information, while real-time collaboration tools enable faster consensus building. This streamlined approach eliminates email chains and version control issues, accelerating the entire decision-making process.