In the fast-paced world of commercial real estate (CRE) lending, Finanta strides to be the beacon of innovation and efficiency. Our tailored software solutions are designed to empower CRE lenders with the tools they need to navigate the complexities of the market, streamline operations, and maximize profitability.

CRE companies face a unique set of challenges that threaten to undermine their competitiveness and efficiency.

Complex Underwritting

Navigating the intricacies of CRE underwriting and risk assessment.

Regulatory Complinace

Keeping up with evolving regulations and ensuring adherence.

Data Management

Efficiently managing and analyzing large volumes of property and financial data.

Market Volatility

Adapting to fluctuations in the real estate market and economic conditions.

Operational Efficiency

Streamlining processes to reduce costs and increase speed.

Our comprehensive suite of lending software is designed to empower your bank with cutting-edge tools for every aspect of CRE lendin

Simplify and accelerate the underwriting process with our sophisticated analytics and risk assessment models.

Stay compliant with ease, thanks to our up-to-date regulatory tracking and reporting tools.

Manage property and financial data effortlessly with our integrated data management platform.

Stay ahead of market trends and make informed decisions with our real-time market analysis tools.

Automate routine tasks, reduce errors, and enhance operational efficiency with our workflow automation features.

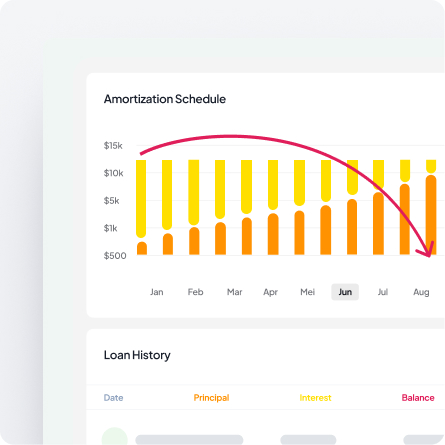

Easily monitor loan portfolios and performance to act faster and mitigate defaults.

Manage property and financial data effortlessly with our integrated data management platform.

Stay ahead of market trends and make informed decisions with our real-time market analysis tools.

Our solution is designed to drive significant improvements across key metrics, ensuring your institution stays competitive and efficient in a rapidly evolving market:

Reduce underwriting time and costs while maintaining accuracy.

Make data-driven decisions with comprehensive analytics and reporting.

Achieve a balanced loan portfolio with managed risks and maximized returns.

Adapt quickly to market changes and seize opportunities with confidence.

Boost efficiency and profitability through process automation and optimization.

Optimize commercial loan origination for a 40% efficiency boost.

Achieve upto 72% reduction in cost overheads

Automate loan management for a powerful 55% increase in loan volumes.

Cut risk exposure by up to 33% with our advanced risk assessment tools.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

Contact Finanta today to schedule a demo and discover how our solutions can propel your bank into the future of lending.

Finanta significantly reduces underwriting time and costs while maintaining accuracy through automated valuation integration, standardized risk assessment workflows, and intelligent document processing. The platform handles the unique complexities of CRE lending—including property appraisals, environmental assessments, market analysis, and rent roll evaluations—all within one unified system. This streamlined approach allows your underwriting team to process more deals faster without sacrificing the thorough analysis required for commercial real estate loans.

Finanta provides comprehensive analytics and reporting specifically designed for commercial real estate lending. The platform delivers data-driven insights including portfolio composition analysis, property type performance metrics, geographic concentration reports, loan-to-value trend tracking, and market risk assessments. These analytics enable you to make informed decisions about portfolio balancing, identify opportunities for growth, and proactively manage risks associated with specific property types or market segments.

Finanta’s platform is built for agility, allowing CRE lenders to quickly respond to market fluctuations and seize opportunities. The system provides real-time market data integration, dynamic risk modeling that adjusts to changing conditions, and flexible underwriting criteria that can be modified as market conditions evolve. This adaptability ensures you can confidently navigate market volatility, adjust lending strategies quickly, and maintain competitiveness even during uncertain economic periods.