Crafting seamless lending experiences that borrowers value. Discover the Finanta difference for a bespoke borrowing experience that sets you apart.

Elevate your service with Finanta’s Borrower Portal, where intuitive design meets functionality, offering real-time loan updates, automated alerts, secure document management, and covenant tracking—all in one place..

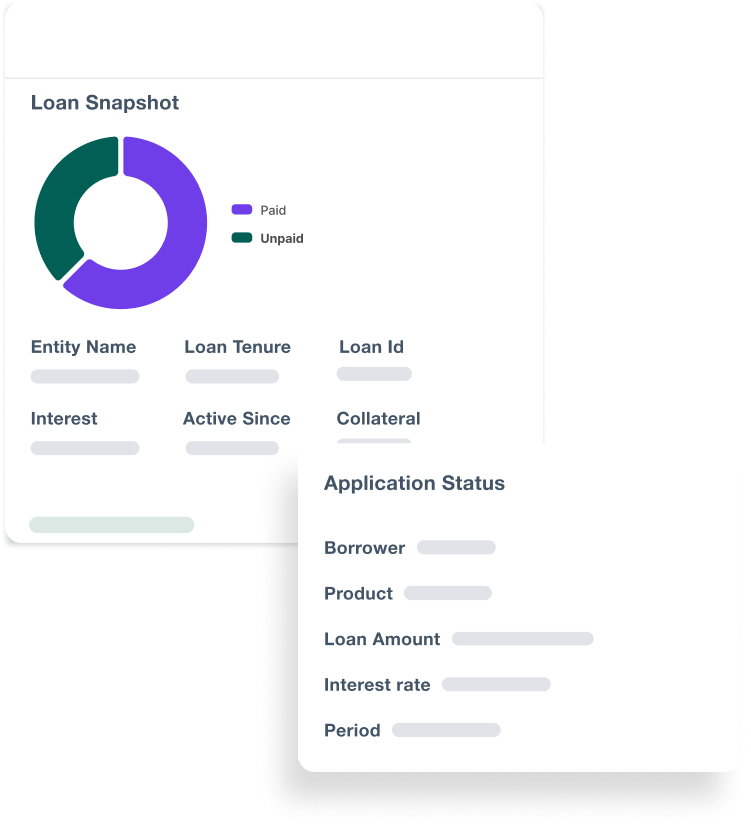

Real-Time Loan Status & Convenant Tracking

Display loan status, payments, automated alerts, notifications and covenant tracking for borrowers.

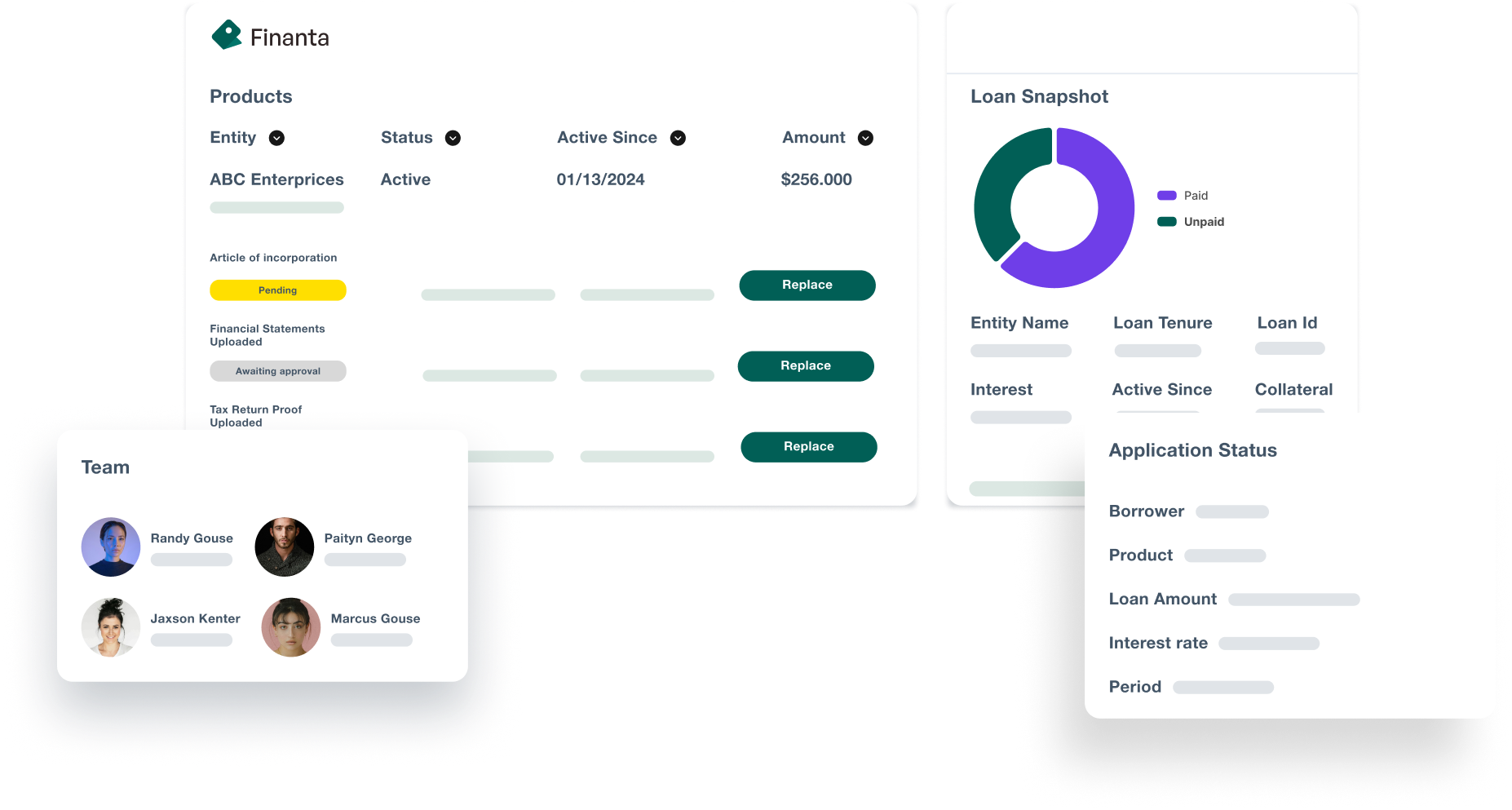

Document Hub

Simplify document management with easy requests, uploading and review of documents.

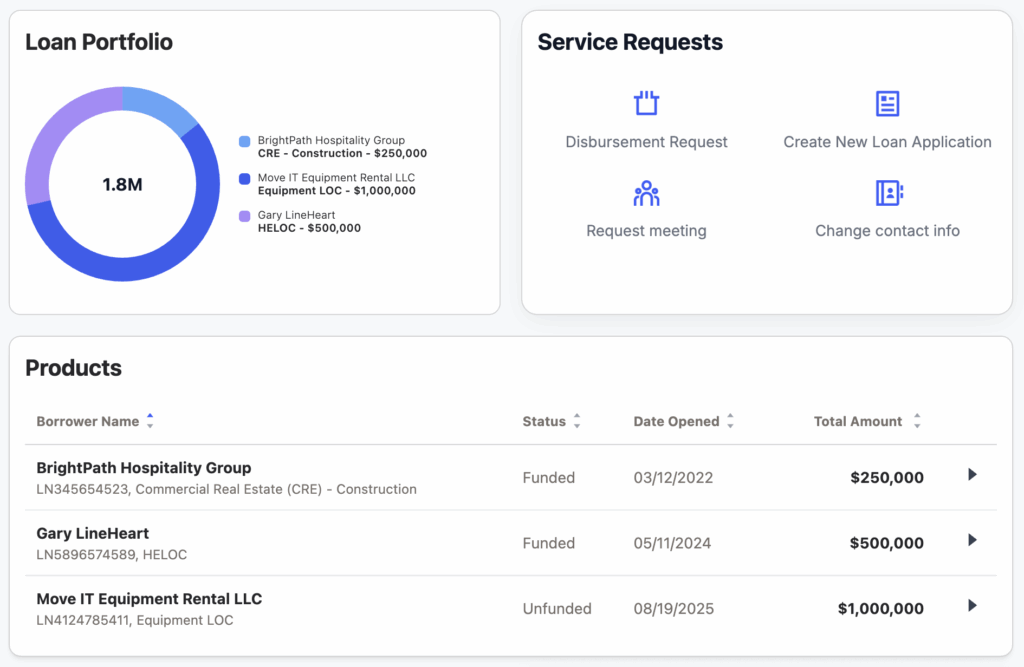

Comprehensive Portfolio Visualization

Offer a complete view of the borrower’s relationship for easier access, more efficiency and customer satisfaction.

Role-based access and Visualizations

Offer secure, tailored experiences with permissions based on borrower roles within each loan context.

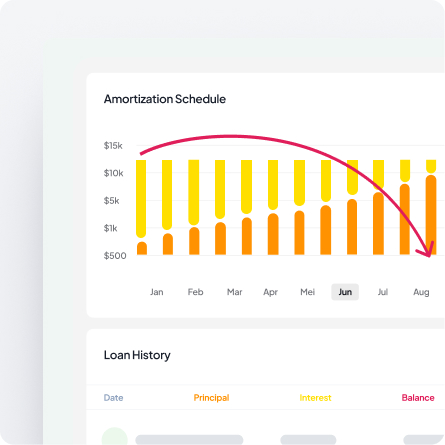

Payments Hub and Amortization Schedule

Provide payment reminders, scheduling and information on the payments hub and amortization schedules for the borrowers loans.

Borrowers often face rigid lending processes. Finanta provides a responsive, multichannel portal that ensures easy access and a smoother lending journey.

A lack of clear communication can hinder borrower trust. Our portal offers real-time loan status and alert systems for complete transparency.

Generic lending solutions fail to meet individual needs. Finanta leverages data to offer personalized terms and communication, resonating with the borrower’s financial narrative.

Embrace a lending solution that’s designed not just for today but for the future. Finanta’s Borrower Portal is built to adapt, ensuring lenders and borrowers are equipped for the changes tomorrow brings.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

“By leveraging Finanta’s comprehensive commercial lending solutions suite, IBC Bank will not only enhance their operational efficiencies but also provide their clients with superior lending products and services tailored to the dynamic commercial lending sector.”

Finanta’s Borrower Portal provides borrowers with 24/7 self-service access to their loan information, including real-time loan status updates, payment history, outstanding balances, upcoming payment schedules, and covenant compliance tracking. Borrowers can securely upload and download documents, receive automated alerts for important deadlines, and manage their entire loan relationship through an intuitive, user-friendly interface accessible from any device.

The portal transforms the borrowing experience by providing complete transparency and control. Borrowers no longer need to call or email for basic loan information—everything is available instantly in one centralized location. Automated alerts keep them informed of payment due dates, covenant requirements, and document requests, while secure document management eliminates the need for paper-based processes. This self-service approach enhances satisfaction while reducing administrative burden on your lending team.

Yes. Finanta’s Borrower Portal employs enterprise-grade security measures including encrypted data transmission, secure authentication, role-based access controls, and regular security audits. All borrower data and documents are protected with the same stringent security standards used throughout the Finanta platform, ensuring that sensitive financial information remains confidential and secure while still providing borrowers with convenient access to their loan information.