Elevate your asset and collateral oversight with Finanta, where security meets innovation in commercial lending.

Finanta revolutionizes the commercial lending cycle with a focus on efficiency, adaptability, and client success. Our Loan Servicing module streamlines post-origination management, ensuring consistent lender-borrower engagement and the agility to meet evolving financial demands with robust reliability.

Our module integrates with leading document management systems to provide a secure, centralized repository for all loan documents, ensuring easy access and management throughout the loan lifecycle.

Stay ahead with real-time collateral monitoring and evaluation, backed by an automated workflow that ensures your lending decisions are informed and timely

From digital signature management to the automated generation of loan documents, Finanta leverages cuttingedge technology to streamline every step of asset management.

With support for 36 types of collaterals and the capability to create custom solutions, Finanta ensures that lenders have the flexibility to manage a diverse portfolio efficiently.

Centralized Document Management

Enjoy seamless integration with document management systems and esignature platforms for secure, efficient document handling and version control.

Real-Time Evaluation and Monitoring

Implement real-time collateral evaluation and monitoring, supported by a robust inspection management system and automated evaluation workflows.

Automated Document and Template Creation

Utilize AI-driven tools (upcoming) and pre-defined templates that align with institutional guidelines, simplifying proposal, narrative, and loan package creation.

Advanced Lien Tracking

Maintain control with advanced lien tracking and notifications, ensuring all collaterals are correctly managed and secured throughout the loan period.

Market Analysis and Collateral Valuation

Benefit from comprehensive market analysis tools to accurately determine the value of collaterals, enhancing decisionmaking and risk management.

Finanta’s Asset and Collateral Management Module represents the pinnacle of lending technology, designed to empower lenders with the tools necessary for effective and secure asset management. Our platform not only simplifies the complexities associated with collateral management but also ensures compliance, accuracy, and lender peace of mind.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

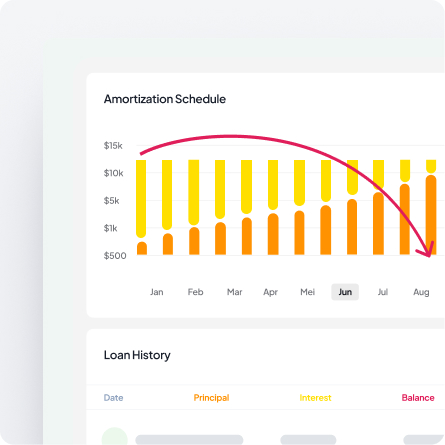

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.

“By leveraging Finanta’s comprehensive commercial lending solutions suite, IBC Bank will not only enhance their operational efficiencies but also provide their clients with superior lending products and services tailored to the dynamic commercial lending sector.”

Finanta supports 36 different types of collateral, covering a comprehensive range of asset classes commonly used in commercial lending—including real estate, equipment, inventory, accounts receivable, vehicles, securities, and more. Additionally, the platform provides the flexibility to create custom collateral types, ensuring you can efficiently manage even the most diverse loan portfolios with specialized asset requirements.

Finanta provides real-time collateral monitoring and automated evaluation workflows that continuously track the value and status of pledged assets. The platform integrates with valuation services and market data sources to ensure your collateral assessments are always current and accurate. Automated alerts notify you of significant value changes or potential issues, enabling timely decision-making and proactive risk management.

Finanta integrates with leading document management systems to create a secure, centralized repository for all collateral-related documentation. The platform handles everything from digital signature management to automated document generation, ensuring all collateral agreements, lien documents, and supporting files are easily accessible throughout the loan lifecycle. This streamlined approach eliminates manual paperwork and ensures compliance with documentation requirements.