A modern commercial lending solution that delivers exceptional customer experiences with seamless digital integration, smart data aggregation, and automated risk scoring.

Achieve faster approvals, reduce manual efforts, and process higher volumes of loan applications effortlessly and efficiently with Finanta.

Ensure regulatory compliance with automated KYC, AML, and risk assessment tools.

Generate comprehensive reports and gain real-time insights into your lending portfolio.

No more disparate systems. Finanta seamlessly integrates loan origination, processing, maintenance, servicing and more creating a unified leading powerhouse.

Easily scale your lending operations with Finanta’s highly scalable infrastructure. A cloud-first approach that avoids overexposure while optimizing your portfolio.

Improve operational efficiency and enhance staff productivity with automated processes, accelerated loan approvals, and reduced manual tasks.

Get a 360-degree view of customer relationships, demographics, and more. Leverage customer insights to cross-sell, up-sell, and improve retention

Optimize commercial loan origination for a 40% efficiency boost.

Achieve upto 72% reduction in cost overheads

Automate loan management for a powerful 55% increase in loan volumes.

Cut risk exposure by up to 33% with our advanced risk assessment tools.

Unmatched Digital Experience

Process Efficiency

Superior Regulatory Compliance

AI Decisioning

Data Aggregation

Assemble your white-labeled platform and digital borrower and lender experience, bringing together rules engines, marketplace services, workflows, integrations to core banking and in-house legacy systems into a seamless platform.

Reduce manual processes impacting origination, utilization, due diligence, underwriting and document processing using workflows, pre-filled templates for document management and digital credit presentation. Reduce corresponding per loan cost for origination and maintenance.

Leverage complaint templates, workflows and rules engines pre-baked into the platform, integration best-in-class due digilence, AML and sanctions compliance services to de-risk your loan portfolio

Smaller banks and credit unions without custom built platforms are able to bridge gaps in technology maturity and produce offering comparable to corporate banks, challenger banks and non-bank lenders by leveraging marketplace services for automated credit decisoning, risk scoring, due diliegnce etc.

Leverage our Data Aggregation API and Open Banking API to swiftly gather and process financial information. With Finanta, effortlessly tag, store, and analyze structured data, enhancing your capability to access and utilize alternate credit insights. Our system simplifies data collection, ensuring a streamlined and efficient approach to credit analysis and decision-making.

Finanta revolutionizes loan origination by streamlining client inquiries and pre-qualification, while automating application processes for a global lending solutions.

Finanta transforms loan approvals by seamlessly compiling and presenting loan proposals using advanced digital tools for informed decision-making.

Finanta ensures impeccable compliance with automated KYC and anti-money laundering systems, adhering to regulatory and internal policies effortlessly.

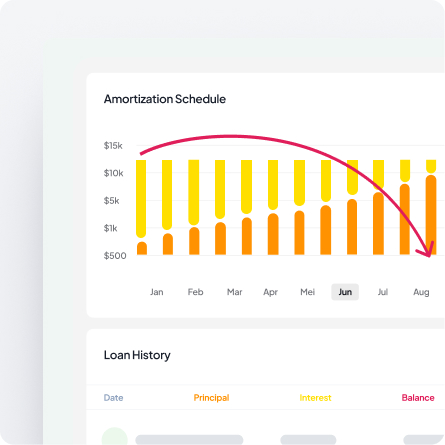

Revitalize loan servicing with Finanta’s efficient fund disbursement, real-time payment monitoring, and enhanced customer support through a comprehensive digital approach.

Finanta excels in loan portfolio management by offering advanced tools for performance monitoring, risk management, and adaptive portfolio restructuring.

Finanta secures assets and collateral through rigorous valuation and management, ensuring legal compliance and asset integrity throughout the loan term.

Finanta unlocks business insights with customizable reporting and advanced analytics, integrating with BI tools for comprehensive loan performance and market analysis.

Finanta amplifies lending operations with smart third-party integrations and fintech collaborations, leveraging advanced technologies for a competitive edge.